A proforma invoice is the first basic invoice provided by a seller to a buyer before a transaction is finalized. It serves as a quotation which is not a demand for payment. It outlines the terms and conditions of a potential sale, including the description of goods and services, quantity, prices, and other relevant details.

The objective of a proforma invoice is to give the buyer an idea of the costs associated with the transaction before committing. It helps both parties to understand the terms of the deal and can be used for different purposes, such as obtaining customs clearance, securing financing, or serving as a reference for the actual invoice that will be issued once the transaction is finished.

While a proforma invoice resembles a regular invoice in different ways, it mainly includes a statement indicating that it is not a demand for payment. It acts as a tool for negotiation and clarity between the buyer and the seller before the goods or services are delivered. In many cases, a proforma export invoice is the first export document issued when a potential importer expresses interest in purchasing goods or services from an exporter.

Proforma invoices offer several benefits for both buyers and sellers:

Clarity in Transaction Details:

Proforma invoices provide detailed information on the goods or services being offered, including quantities, prices, and any applicable taxes. This helps both parties clearly understand the details of the proposed transaction.

Agreement on Terms:

It allows the buyer and seller to reach an agreement on the details of the sale before the actual transaction occurs. This can prevent misunderstandings and disputes between buyers and sellers later on.

Customs Clearance:

In global trade, proforma invoices are often used to provide customs authorities with detailed information on the goods, their value, and other relevant details. This can provide smoother customs clearance processes.

Budgeting and Planning:

Buyers can utilize proforma invoices to plan and budget for upcoming goods purchases. The document consists of an estimate of costs, helping buyers manage their finances more effectively.

Confirmation of Intent:

By issuing a proforma invoice, the seller confirms their decision to deliver the goods or services as specified. This assures the buyer regarding the availability and pricing of the products.

Terms Negotiation:

The proforma invoice is a starting point for negotiations between the buyer and seller. Both parties can discuss and adjust the details before finalizing the sale.

Payment Information:

Proforma invoices generally include details about payment terms, such as the payment method, due date, and any applicable discounts, which helps streamline the payment process.

Risk Mitigation:

Both parties can estimate the risks associated with the transaction based on the information provided in the invoice. This helps in identifying and addressing potential issues before the actual sale.

Record Keeping:

Proforma invoices provide proper record-keeping for both buyers and sellers. They serve as a reference point for the terms agreed and can be used for accounting purposes.

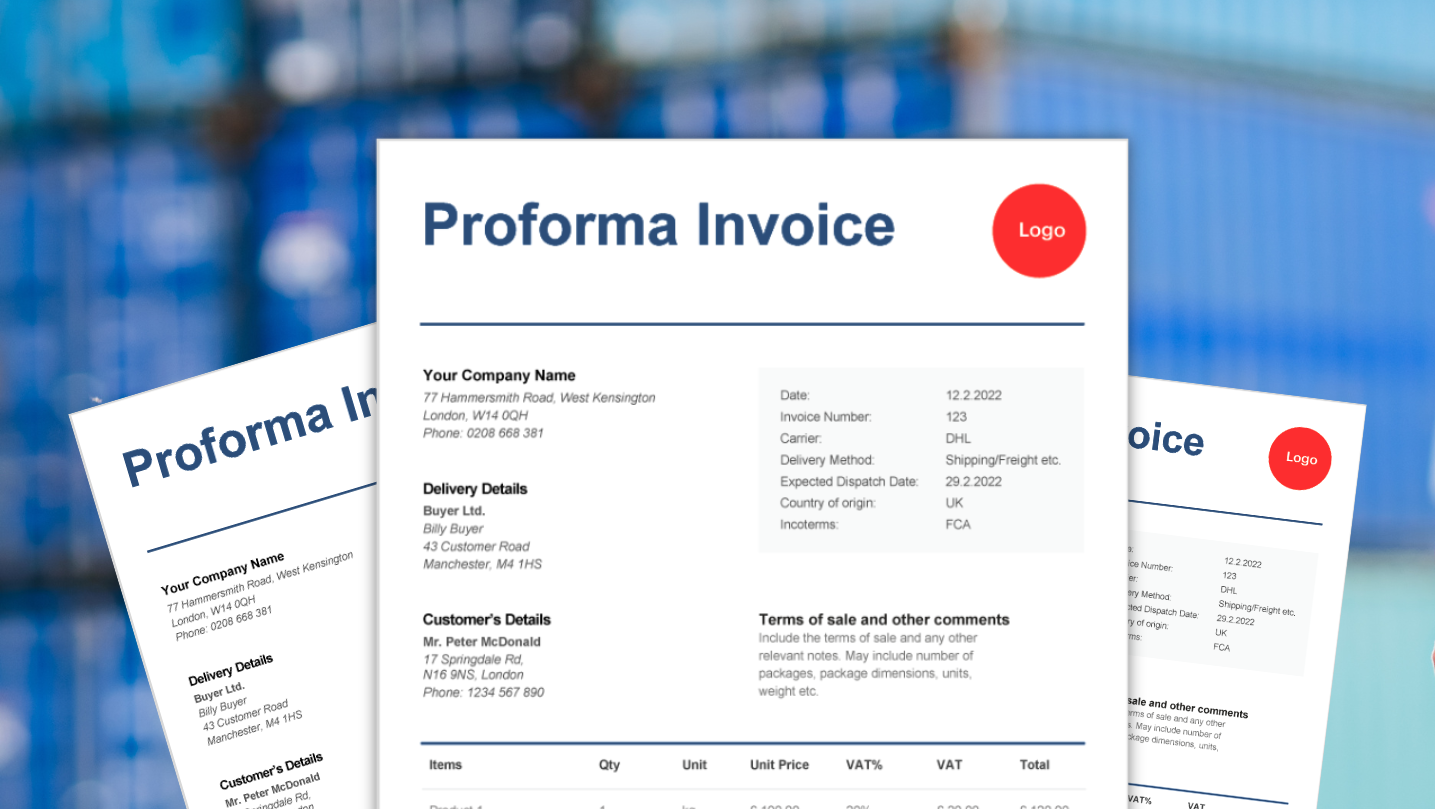

The points to be included in the proforma invoice are:

- Seller’s name, company name and address

- Buyer’s name, company name and address

- Buyer’s reference

- Items quoted and details

- Prices of items: per unit, quantities, and extended totals

- Weights and dimensions of quoted items

- Discounts, if applicable on items

- Terms of sale (include delivery point)

- Terms of payment

- Estimated item’s shipping date

- Validity date

Here are the main distinctions between a proforma invoice and other types of invoices:

Purpose and Timing:

Proforma Invoice: Invoice is Issued before the actual sale occurs. It provides an estimate of the cost of goods and serves as a quotation to deliver the products or services under specified terms.

Commercial Invoice: A commercial invoice is Issued after the sale has been completed and the goods or services have been delivered. It is a formal demand for payment.

Legal Status:

Proforma Invoice: A proforma invoice is not a legally binding document. It is more of a quotation or a preliminary agreement that guides the actual transaction.

Commercial Invoice: A commercial invoice is a legally binding document that indicates the actual sale of goods or services and is used for customs and taxation works.

Payment Terms:

Proforma Invoice: A Proforma invoice usually includes proposed payment terms, but actual payment is not made until a commercial invoice is provided after the completion of the transaction.

Commercial Invoice: A commercial invoice Contains the final agreed-upon payment terms, and payment is expected based on these terms.

Use in International Trade:

Proforma Invoice: Often used in international trade to provide the buyer with detailed information about the transaction, including the cost of goods, shipping charges, and other important details.

Commercial Invoice: It is important for customs clearance and is used to calculate duties and taxes in international trade.

Concluding, a proforma invoice is a preliminary document issued before the sale, serving as a quotation or an agreement in principle. Commercial invoices, on the other hand, are formal demands for payment issued after the completion of the sale, and they are legally binding documents used for accounting, customs, and taxation purposes.