The international trade journey demands precise planning and various regulatory requirements. Letter of undertaking registration is one such crucial aspect for export businesses. In this blog post, we will go through the significance, benefits, functioning, and necessary steps for obtaining an LUT for a hurdle-free export business. Let’s dive into the details.

What is a Letter of Undertaking?

A Letter of Undertaking (LUT) is a legal document issued by the exporter to the government, declaring their commitment to stand by all the rules and regulations governing exports. It serves as a guarantee that the exporter will fulfill their obligations and obey the prescribed guidelines during the export process.

Why is a Letter of Undertaking important for the export business?

The LUT is essential for exporters seeking to conduct business without paying the Integrated Goods and Services Tax (IGST) on exports. It facilitates a smoother export process by removing the need for advanced payment of taxes, promoting cash flow efficiency for businesses involved in international trade.

Benefits of Letter of Undertaking Registration:

- Cash Flow Advantage: Allows exporters to export goods or services without the immediate task of tax payment, preserving liquidity.

- Competitive Edge: Enhances the competitiveness of exporters by reducing the financial pressure associated with tax payments.

- Administrative Ease: Streamlines export transactions by removing the need for frequent refund claims, reducing paperwork and processing time.

Functioning of Letter of Undertaking:

The LUT operates as a legal commitment, binding the exporter to obey the GST regulations related to exports. Once registered, it enables the exporter to ship goods without paying the IGST, provided the export proceeds are received in foreign exchange.

Terms & conditions and validity for Letter of Undertaking registration:

- Validity Period: The Letter of undertaking is generally valid for a financial year and must be renewed annually.

- Conditions: Exporters must accept the conditions specified by the authorities, including timely submission of export proceeds and attachment to other regulatory norms.

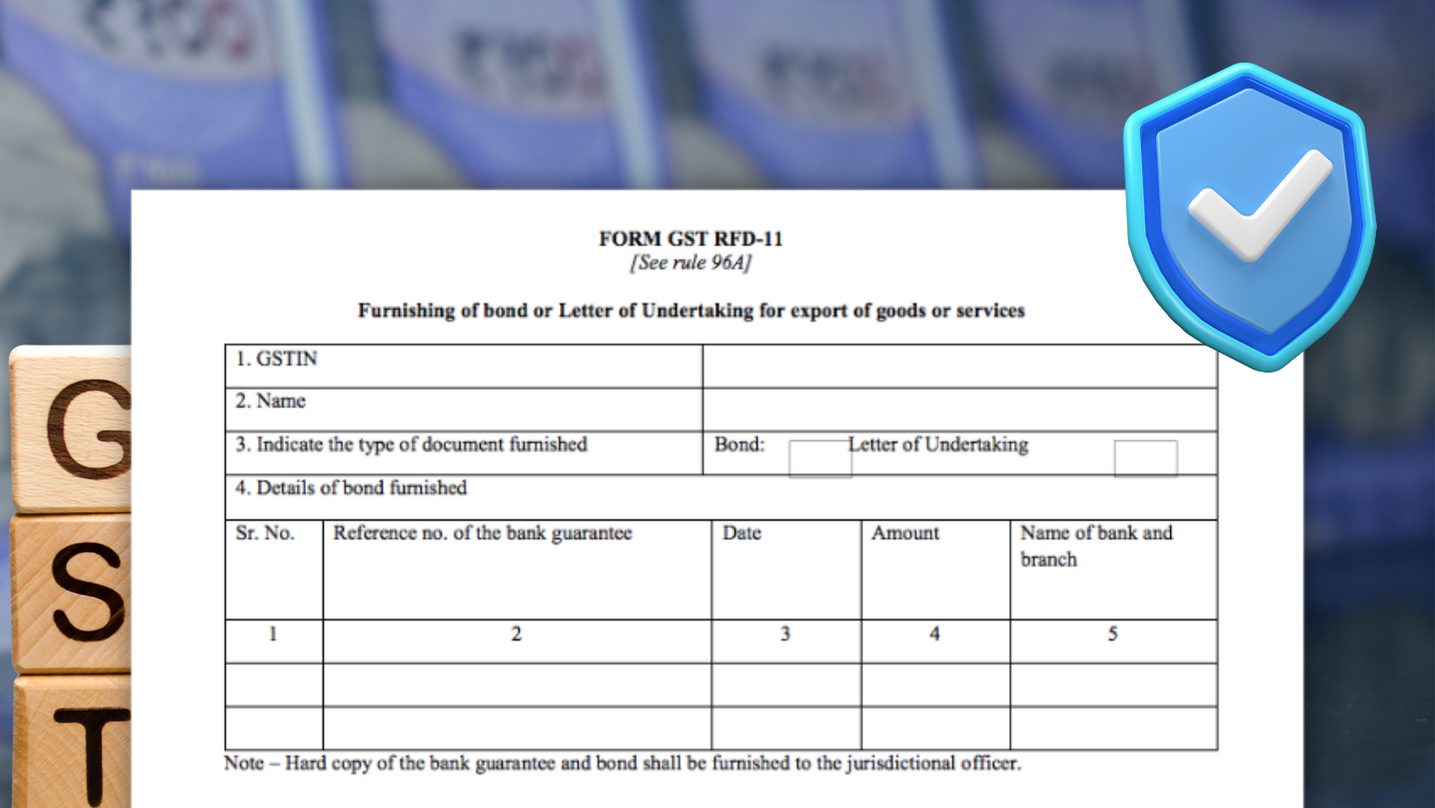

Documents required to file Letter Undertaking under GST:

Previous year LUT copy if available.

A copy of GST registration certificate

Compliance and Renewal

If you fail to obey the letter of undertaking GST rules, you may be subject to penalties, depending on the nature of the violation.

For example, if you fail to submit an LUT before exporting services, you may be liable to pay the full amount of IGST. You may also be subject to a penalty of up to 100% of the IGST you should have paid.

Moreover, A LUT copy is valid for only one financial year. This means that you must renew your LUT every year if you want to continue exporting without paying IGST. Typically, the deadline for renewing your LUT falls on March 31 of every year in the same financial year in which it expires.

Common Challenges and Solutions

Rectification and amendment procedures can also present challenges. Mistakes or changes in submitted documents may require rectification.

To tackle this, it is important to carefully review all documents before submission and quickly address any errors. Seek guidance from experts in the field to navigate through the rectification process smoothly.

For comprehensive guidance and a hassle-free registration process in obtaining LUT for your export business, consider approaching PWIP. By choosing PWIP, you can benefit from their expertise in understanding the requirements and intricacies involved in the letter of undertaking registration process. PWIP ensures the best experience, allowing you to focus on the core aspects of your export business. Unlock the door to international trade confidently through proper Letter of Undertaking registration.