Indian exporters of basmati rice and tea are expressing concerns following Iran’s recent attack on Israel, fearing potential repercussions on the outward shipment of these commodities. Additionally, edible oil importers are wary, anticipating a possible rise in sunflower oil prices.

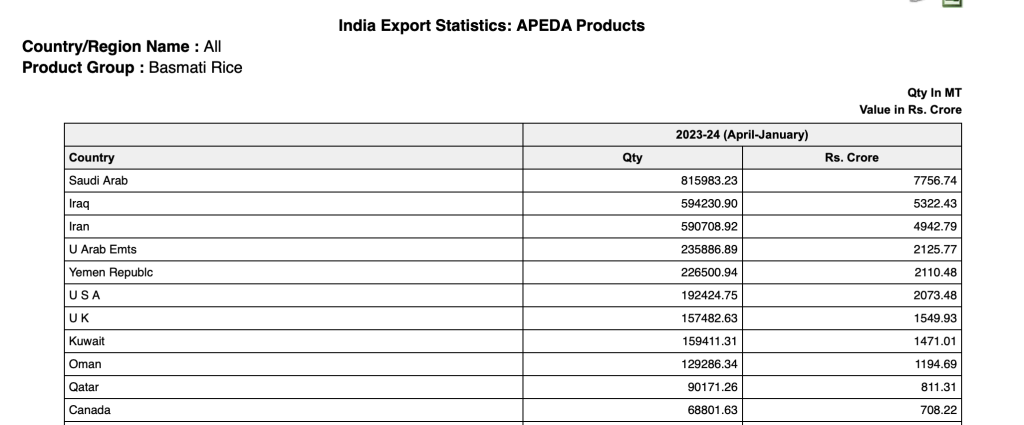

Iran constitutes a significant market for Indian basmati export, accounting for approximately $598 million of the total nearly $4.59 billion worth of basmati rice exported in the first 11 months of the last fiscal year, according to government data. Moreover, exporters are aiming to send 40 million kilograms of tea to Iran this year.

Statements from Basmati Rice, Tea Exporters

Countries such as Iran, Israel, and adjoining nations are major consumers of basmati rice. If the region turns into a conflict zone, Indian exports could get heavily impacted, said a large rice exporter asking not to be named.

“Shipping routes will change if the tension further escalates. Then it will become a very difficult situation for the basmati rice exporters. This week is very crucial for us,” said Vijay Setia, a leading exporter and former president of All India Rice Exporters Association.

Tea exporters, who were looking forward to further expanding their business with Iran this year, are also a nervous lot. “The first two sales from Iran have been robust and we were thinking that situation will be normal this year,” said Mohit Agarwal, director of Asian Tea Company, a leading tea exporter to Iran, adding that tea shipments could be impacted if Israel retaliates, leading to escalation of the conflict.

Source: Economic Times

Other Impacts from Israel-Iran Conflict – Oil Imports Affected

India is the world’s third-largest consumer of crude oil and depends on imports to meet over 85% of its requirements. Given the country’s extremely high import dependency, India’s economy is highly sensitive to oil price volatility.

Almost half of it comes from West Asia and travels by the strait of Hormuz, which lies between Iran & Oman, & its an essential route for the world’s oil supplies. Over 17 million Barrels of Oil move from here every day, that’s 1/6th of the world’s Oil. It’s a narrow passage that connects the Persian Gulf to the Indian Ocean. If this War happens, this route might be compromised & the 4 major Oil producing Nations – Saudi Arabia, Kuwait, UAE, Iran, will be impacted.

Source: First Post

Ajay Bagga, a Market Expert, says “the main risk to India and other oil importers is the oil price. Otherwise, it is a regional conflict. It is not that major. But the risk is that if Iran chooses to strike on Saudi oil refineries or brings down oil shipping in the Persian Gulf. So, India will stay equidistant. Israel is a friend of India as is Iran. So, as far as the foreign policy goes, do not expect India to take any sides. Overall, our economy is not that impacted, but oil prices will be if this conflict escalates.”

Conclusion

The recent surge in Middle Eastern tensions creates a complex web of challenges for the Indian economy. This includes disruptions to critical exports and vulnerabilities in oil imports. To lessen the potential economic blows, it’s vital for stakeholders like the government and businesses to stay on top of the situation and develop contingency plans. Furthermore, diplomatic efforts to calm tensions in the region are essential to protecting regional stability and global economic interests.

Looking for more understanding on other Trade News, Check out: India-Singapore Rice Trade Faces Uncertainty Amidst Disagreements and Customs Issues

Do Follow us on Our Social Media channels to stay ahead in your Trading business.