India, the world’s largest rice exporter, is facing a strange situation. While government warehouses are overflowing with non-basmati rice, prices in the domestic market have been steadily climbing & basmati exports are stagnant. Let’s break down this puzzle and see what’s happening in the Indian rice industry.

Rising Non-Basmati White Rice Prices

Currently, the Food Corporation of India (FCI) holds a stockpile of rice four times larger than the buffer stock needed for July 1st. It’s around 502 lakh tonnes of rice—320 lakh tonnes of rice stock and 180 lakh tonnes receivable from millers. This is significantly higher than the buffer stock norm of 135 lakh tonnes required.

However, the average retail price of rice has gone up from Rs 39 per kg last May to Rs 44 per kg recently. This price hike comes despite the government’s efforts to control prices through export bans, selling subsidized rice under the Bharat brand, and auctioning off rice stocks.

| Date | Average Retail Price (Rs/kg) |

|---|---|

| May 2023 | 39 |

| January 2024 | 43 |

| May 2024 | 44 |

To understand this, the government is conducting a study on Non Basmati Rice Varieties.

The focus of the Study:

- Production patterns of different non-basmati rice varieties.

- Consumption patterns of high-value non-basmati rice varieties.

- Whether farmers are focusing on growing rice procured by the government at Minimum Support Price (MSP) for food security schemes.

Speculations of Possible Reasons for Price Rise

- Shift in production towards high-value non-basmati varieties like Sona Masuri and Ponni are not included in the free foodgrain Government distribution scheme for 810 million poor citizens.

- Lower demand for the government’s subsidized rice (“Bharat” brand) or surplus rice from FCI auctions.

Export Duties and Their Impact on Non-Basmati Parboiled Rice

Enter the new Indian government, to be elected on June 4th 2024, who seems disinclined to lift the 20% export duty on parboiled rice. International buyers brace for continued high prices as these restrictions, implemented in August 2022, include a ban on broken rice exports, additional taxes on non-basmati white rice exports, and a minimum price for basmati rice exports, bite harder. The result? A dramatic 18.5% drop in Indian rice exports to 16.5 million metric tons for 2023-24.

| Year | Rice Exports (million metric tons) |

|---|---|

| 2022-23 | 20.25 |

| 2023-24 | 16.50 |

Parboiled rice primarily goes to West Africa, while basmati rice is mainly exported to the Middle East.

The initial objective of the duties was to control the rising food inflation, said a Faridabad-based rice exporter. However, the government has now realized that the levy on parboiled exports is also bringing in millions of USD in revenues without affecting local prices, he said.

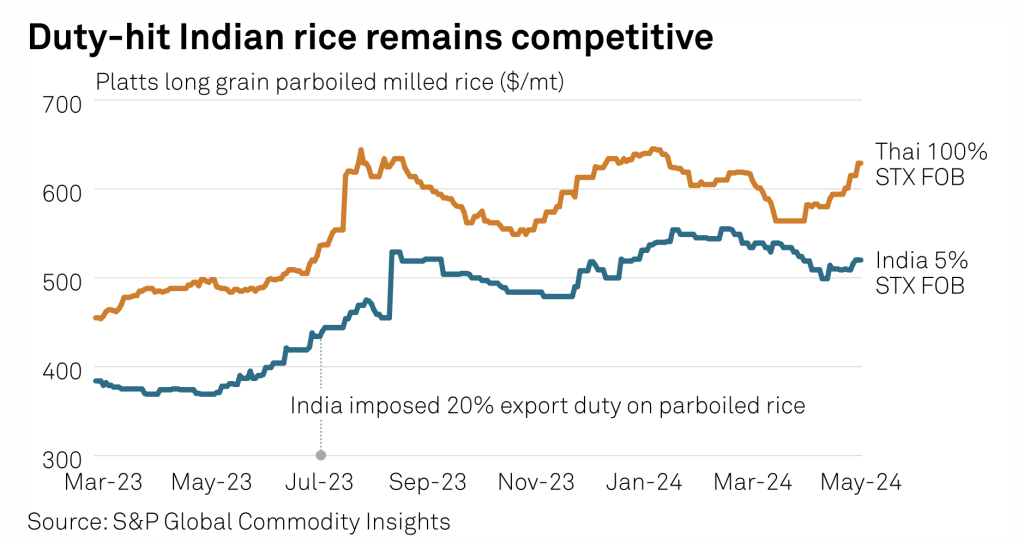

“There’s no reason for New Delhi to remove duties on parboiled rice as it keeps local prices in check and generates additional revenue,” asserts Sandeep Agarwal, business head of rice at Aditya Birla Global Trading. Despite the 20% export tariff, Indian parboiled rice remains the cheapest worldwide, particularly for African consumers, who have no viable alternatives.

Irrespective of which party comes to power, export duties on parboiled rice are not going to be lifted as the price has consistently remained the most competitive in the region, said Raghav Reddy, chief executive officer of MM Mills Ltd, a rice trading company.

For African consumers, there is no viable alternative to Indian parboiled rice, which remains the cheapest in the world despite the 20% export tariff.

The Basmati Rice Export Challenges

In contrast, the basmati rice market is also sinking in challenges. The export price has dropped below the government-fixed minimum of $950 per tonne to $800-$850 per tonne, yet global demand is Slow. Domestic prices have similarly declined from Rs 75 per kg to Rs 65 per kg due to poor export offtake.

“Overseas buyers created a huge stock of basmati rice due to the uncertainty caused by fluctuating MEP policies,” laments Vijay Setia, past president of the All India Rice Exporters Association. The fear of an export ban led buyers to stockpile Indian basmati or turn to Pakistan.

India typically produces around 6.5 million tonnes of basmati rice annually, with 5 million tonnes exported. However, a bumper crop in Kharif 2024 saw production soar to 8 million tonnes. With exports at 5.25 million tonnes and domestic consumption at 1.25 million tonnes, the surplus is evident.

| Year | Basmati Production (million tonnes) | Exports (million tonnes) | Domestic Consumption (million tonnes) | Carry-Over Stock (million tonnes) |

|---|---|---|---|---|

| Typical Year | 6.5 | 5 | 0.5 | 0.5 |

| Kharif 2024 | 8 | 5.25 | 1.25 | 1.5 |

Future Outlook and Challenges

Gautam Miglani, managing partner of LRNK, a 50-year-old Haryana-based basmati rice exporting firm said “Basmati production in Kharif 2025 will be better as the monsoon will be normal. Farmers are buying a good number of seeds for sowing. If the government does not do anything with MEP, then the basmati trade will suffer and Pakistan, our main rival in the global market, will continue to have an edge over us. Prices of rice in the domestic market have already fallen by 10-15% and they may fall further.”

Conclusion

The Indian rice market is a stage for a complex drama, driven by government policies, export duties, and production dynamics. Non-basmati rice prices rise despite surplus stocks, while basmati rice faces regulatory and demand challenges. The coming months will be critical, with significant implications for both domestic and international stakeholders.

This unfolding narrative of surplus and scarcity underscores the intricate interplay of market forces, regulatory decisions, and agricultural realities in the Indian rice market. As the drama continues, the world watches closely.

Check out other updates in the market: Basmati rice exports rose 22% till February FY24 on West Asia demand. Do Follow us on Our Social Media channels to stay ahead in your rice business.